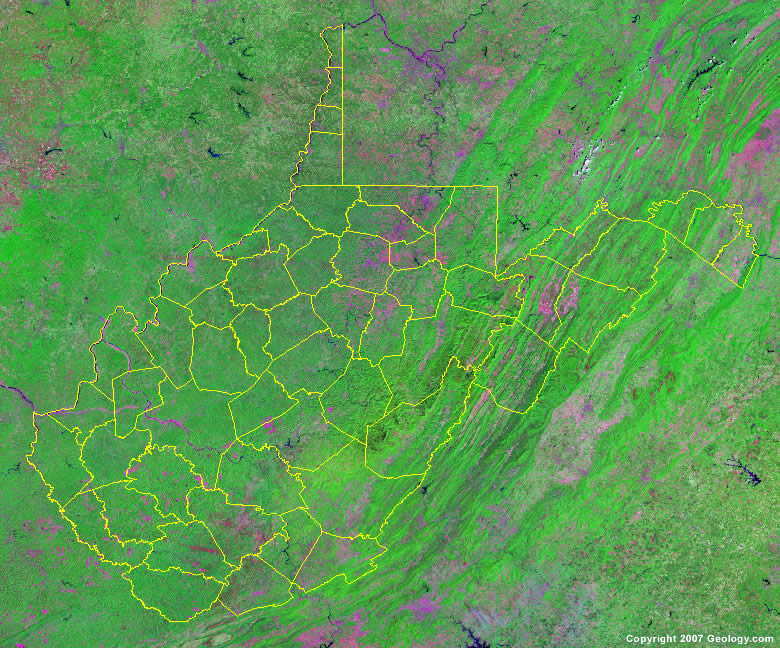

wayne county tax map wv

FOR TAX ASSESSMENT PURPOSES ONLY. So for example lets say you have a home with a market value of 100000.

Survey Of A Tract Of Land On Twelve Pole Creek Wayne County West Virginia Library Of Congress

Click here for a larger sales tax map or here for a sales tax table.

/cloudfront-us-east-1.images.arcpublishing.com/gray/WOQG5QLYE5ANLMPRVUS6BKYNIE.jpg)

. The County Collections Divisions primary function is to return tax-delinquent lands to private ownership so the revenues derived can be allocated to the appropriate counties in West Virginia. Continue Cannot find address. Counties cities school districts and other special tax districts can levy property taxes.

Tax rates in West Virginia apply to assessed value. Its population was 715522 at the 2020 United States census a 1922 increase since the 2010 United States census. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

RootsWeb - the Internets oldest and largest FREE genealogical community. West Virginia Property Tax Rates. This Division is also responsible for preparing annual tax billing statements for each public utility.

Taxpayers may also pay delinquent real property taxes on this website. Various registration and drivers fees were increased to yield an additional 40 million per year. NETR Online Summit Summit Public Records Search Summit Records Summit Property Tax Ohio Property Search Ohio Assessor From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film.

Combined with the state sales tax the highest sales tax rate in West Virginia is 7 in the. It is the principal city of the DenverAurora. Denver ˈ d ɛ n v ər is a consolidated city and county the capital and most populous city of the US.

An award winning genealogical resource with searchable databases free. A Service of the Wayne County Treasurer Eric R. If payments are not made to the county treasurer in a timely manner they become delinquent incurring interest and fees each month they remain unpaid.

More information is available in West Virginia State Code 18B-10-10 or through the West Virginia Higher Education Policy Commission. In certain municipalities the treasurers office will eventually place a property tax lien on the property. West Virginia has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1There are a total of 139 local tax jurisdictions across the state collecting an average local tax of 0246.

The marketplace facilitator makes or facilitates West Virginia sales on its own behalf or on behalf of one or more hotel or hotel operators equal to or. ONLINE TAX FILING Tax payers can do their personal property filing online. In-state Tuition Rates for Nonresident Veterans All public higher education institutions will assess tuition at the in state rate for nonresident recipients of the GI Bill who enroll within three years of their discharge beginning July 2015.

The total tax rate for an individual property is the sum of those rates which are expressed as cents per 100 in assessed value. Our website allows taxpayers to view delinquent property tax information for all municipalities in Wayne County at no cost to the user by entering the Parcel ID Number or street address and city. This lien is a public claim for the outstanding delinquent tax meaning the property cannot be transferred or sold.

Nationwide Environmental Title Research LLC NETR makes no warranties expressed or implied as to the accuracy or completeness of this data. Parcel Address Flood Zone. West Virginia Property Viewer.

In 2017 the West Virginia Legislature enacted various fee increases and tax changes designed to generate at least 125 million per year in additional funds necessary to finance 800 million in Road Bonds. Box 40 Wayne WV 25570 OFFICE LOCATIONS Personal Property Office Room 105 Wayne County Courthouse Real Estate Office 620 Hendricks Street Wayne WV 25570. This is accomplished by redemption of property and by offering the parcels at public auction.

Download Data Search Layers Basemap Tools Clear Help Imagery. The data presented on this website was gathered from a variety of government sources. OFFICE HOURS Monday Tuesday.

If you cannot find an. The motor fuel tax was adjusted upward by 35 cents per gallon to raise an. Effective January 1 2022 marketplace facilitators will be responsible for collection and remittance of the hotel occupancy tax to counties and municipalities in accordance with Section 7-18-4b of the West Virginia Code if.

It is the 19th-most populous city in the United States and the fifth most populous state capital.

Map Available Online West Virginia Real Property Library Of Congress

/cloudfront-us-east-1.images.arcpublishing.com/gray/WOQG5QLYE5ANLMPRVUS6BKYNIE.jpg)

Metric Map For West Virginia Schools Updated Five Counties Red

Political Map Of West Virginia Stock Photo Alamy

Cabell County Map West Virginia

Map Available Online West Virginia Real Property Library Of Congress